Are you considering the credit card debt settlement process?

Debt settlement can be a great alternative to bankruptcy — but it’s not the right solution for everyone.

Over the past 15+ years I’ve talked with people from all walks of life and in every stage of financial distress. Here are answers to the most frequently asked questions I get asked about the debt settlement process …

How does the credit card debt settlement process work?

The general concept is you negotiate a mutually acceptable settlement amount (for less than full balance) with a creditor or collection agency to resolve an outstanding balance.

The creditor or collection agency confirms the settlement in writing. You then remit the settlement funds prior to the agreed upon deadline. When your funds have cleared your bank, your account is settled and no further balance is due.

For additional details on how debt settlement works, please click here.

Why would a creditor accept less than full balance? What’s their motivation?

It’s purely a business decision on their part. It takes time, effort and money to collect past due debts and/or take people to court – and then possibly collect nothing in the end. Under the right circumstances it makes more financial sense for credit card companies and collection agencies to cut their losses, settle and move on. It’s all about maximum net recovery and “not throwing good money after bad money”.

What types of debt can be settled for less than full balance?

Unsecured debt — primarily credit card debt, but also medical debt and some department store cards and personal loans.

Secured debt cannot usually be settled because it is secured by property that can be repossessed or foreclosed upon in the event of delinquency.

Student loans, although they are not secured by property, are treated as if they were a secured debt because at the present time it is next to impossible to discharge student loans in bankruptcy. In other words, with student loans you have very little negotiating leverage because student loan debt collectors know it’s very difficult to discharge them in bankruptcy.

What are the criteria to be eligible for debt settlement?

We can’t speak for other debt settlement companies, but at Donaldson Williams the following 3 criteria must be met before we’ll accept someone as a client:

- Legitimate financial hardship. No bank or credit card company is going to write off thousands (or tens of thousands) of dollars for no good reason. Nor should they. Our feeling is if you have the ability to pay, you should honor your financial commitments. But if you can honestly say you’ve suffered a legitimate financial hardship and you’d prefer not to file bankruptcy, then it’s perfectly acceptable to approach your creditors about negotiating settlements for less than full balance. Examples of legitimate financial hardships include (a) A messy and expensive divorce, (B) Job loss, (c) Medical emergency, etc.

- Sufficient funds. You’ve got to have some money to work with. You can be the nicest, sweetest, most well-intentioned person in the world, but if you don’t have any money to work with, there’s not much that can be done. How much money will you need? It’s impossible to say exactly. But if you know what you’re doing, in most cases you should be able to negotiate settlements with your creditors for $0.50 on the dollar or less – in some cases even $0.30 or $0.40 on the dollar. There are no guarantees and your results could be higher or lower than this. We’re just giving you an estimate based on what we’ve observed over the past decade.

- Proper timeframe. How long should the debt settlement process take? Short answer >> Not a day longer than is absolutely necessary. You want to get through the debt settlement process as quickly as possible because, (a) Interest and late fees continue to accumulate on your accounts until they are settled, (b) You want to minimize the chance of getting sued. If possible, we recommend completing the debt settlement process in 12-18 months or less. The sooner, the better.

Where do people get the money for settlement purposes?

- One of the most common sources is “love” money – from people that love you. It’s not like you’re asking for a bail out. Instead, it usually takes the shape of a personal loan, then after the debt is settled you make private arrangements to pay back the money to the friend or family member that loaned you the money. (If you have a rich uncle saying you don’t have to pay him back, well God bless your rich uncle.)

- You could secure funds using a home equity line of credit. Obviously if you don’t own a home this isn’t an option.

- You could liquidate (or take a loan against) your retirement account. It’s true you might have to pay taxes or penalties for early withdrawal from your retirement account, but the amount of debt relief you obtain might far offset any taxes or penalties you would incur. Normally it is advisable to avoid tapping into a retirement account, if possible. But if you’re strapped for cash, possibly on the verge of bankruptcy, tapping into your retirement account to eliminate debt for less than full balance might be a sacrifice worth making.

- You could sell something – a car, a boat, your Harley, a piece of property, etc. Maybe you sell your existing home and downsize to a less expensive one.

- You could accumulate money, month after month, from your paycheck.

Bottom line: If a person wants it bad enough, they can usually find a way to come up with the money. Not always. But usually.

Should I hire a debt settlement company or attempt settlements on my own?

It is entirely possible to settle your credit card debt on your own so you can avoid paying a fee to a debt settlement company. Nothing wrong with trying to save a few bucks.

However, you need to be aware of the following:

- Attempting to negotiate your own settlements assumes you’re a good negotiator. Do you have the personality and temperament to be a good negotiator? This isn’t like haggling over the price of a used car. Debt collectors can be vicious bulldogs. It’s how they make they’re living. So you have to be up to the task.

- Debt settlement professionals have access to scouting reports on all the major credit card companies and collection agencies. Each financial institution and agency has their own unique settlement procedures and nuances. It’s not a one-size-fits-all thing. Unfortunately there’s nowhere on the internet you can just download this info. You only get this critical data by working in the industry week in and week out. Scouting reports are the # 1 reason we get favorable settlements for our clients.

- Sometimes it’s not what you know but who you know. An experienced debt settlement professional will know representatives at credit card companies and collection agencies that will do deals strictly because you’ve worked with them before. If you’re trying to negotiate settlements on your own, you won’t have access to these higher level contacts that can give you what you want. You’ll usually be forced to deal with entry level gatekeepers whose job is to thwart your efforts.

- When it comes time to do a settlement, you must have the proper paperwork in place before funds are released. Without proper settlement paperwork, you run the risk of being liable for the remaining balance at a later date. If you have the correct paperwork in place, once you release the funds to settle your account, the matter is final and no further balance is owed. A competent debt settlement professional will review your paperwork for accuracy and completeness.

How do you decide which debt settlement company to hire?

There are several ways.

- First, check online for positive reviews or testimonials from former clients … either on their company website or a 3rd-party review site. Obviously, an abundance of negative reviews should be a red flag.

- You should also check for a good rating with the Better Business Bureau. It’s not mandatory that they have a good rating with the BBB, but it’s another good sign.

- Also, a good debt settlement company will not hold your settlement funds in escrow. Instead, you will maintain possession of your own funds at all times, and your funds will only be released after a settlement has been obtained.

- Another caution flag would be a debt settlement company that requires exorbitant fees upfront before any work is performed. Instead, look for a debt company whose fees are contingent upon the results, and their fees are paid at the time of settlement.

- A good debt settlement company will be easily accessible, always responding promptly to any phone calls and emails from their clients.

- Finally, you should get a good feeling about the debt settlement company you’re considering to work with. If something doesn’t feel right, walk away. Trust your gut it’s usually right. For instance, if a debt settlement company is using high pressure sales tactics to try and recruit you as a client, it’s probably best to say adios and talk with a different company.

How much do debt settlement companies charge?

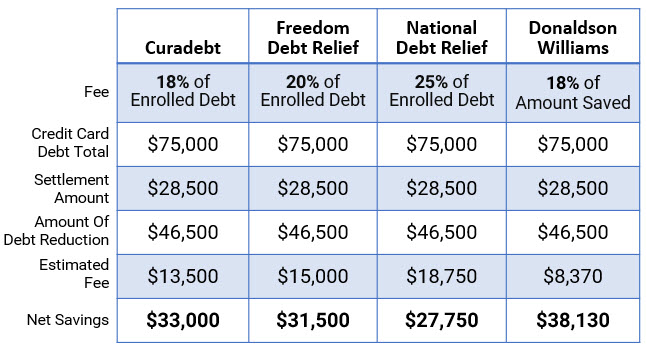

We did some “mystery shopping” and spoke with several debt settlement companies to see what they charge for their services.

We then crunched the numbers for a hypothetical situation where someone (a) had $75,000 in credit card debt, and (b) their debt was settled for $0.38 on the dollar.

Here’s how the numbers worked out …

Key takeaways:

- The fee charged by Curadebt, Freedom Debt Relief and National Debt Relief is based on a percentage of the overall debt total. The fee charged by Donaldson Williams is based on the amount of debt reduction.

- Donaldson Williams’ fee structure resulted in the largest net savings.

Will I receive calls from creditors during the settlement process?

Yes, you can expect to receive some calls from your creditors during this process. Unfortunately, creditors are still legally entitled to contact you about past due balances, even if you’re waving the white flag and attempting voluntary settlements.

There was a time in the past where creditors would stop making collection calls if asked. But those days are long gone. If you retain Donaldson Williams to assist you, we can help keep these calls to a minimum.

We have an excellent, free resource titled, “How To Deal With Debt Collectors”. You can download it here.

Caution: Certain websites claim you can send a “cease and desist” letter to stop collections calls. This is a bad idea. Sending such a letter could actually prompt creditors to fast track your account for legal action. For this reason, “cease and desist” letters are not recommended.

Can my wages be garnished?

Yes and no.

Many debt collectors infer that they will immediately garnish your wages if you do not pay your outstanding credit card balance. However, wage garnishment is not that quick and simple.

A creditor cannot garnish your wages until they secure a judgment against you in Court. And before a creditor can get a judgment against you, they have to win a lawsuit against you in your local jurisdiction. And to win a lawsuit against you, they have to hire an attorney, file a lawsuit with the Court, serve you with the lawsuit, etc, etc.

There are a lot of steps, as well as expenses, to pursuing you legally on an outstanding credit card balance. For that reason, most creditors prefer to reach a voluntary settlement.

Historically, it’s been our experience that only about 2% of our clients’ accounts end up in litigation. So do creditors file lawsuits? Yes, but not often — at least far less often than they’d have you believe. The good news is even though an account might end up in litigation we nearly always resolve them before it gets to court, either via lump sum settlement or payment arrangements.

Is credit card debt settlement really legal?

Yes, it’s one of the best kept secrets in the credit card debt industry and it’s perfectly legal. Financial companies settle debts every day when they determine it’s in their best interest to cut their losses and maximize their net recovery. As you might expect, they’re not going to write off thousands or tens of thousands of dollars without a fight. But if you handle things properly, it’s entirely possible to obtain debt relief totaling thousands or tens of thousands of dollars … without the need to file bankruptcy.

How much will creditors settle for?

Obviously every situation is different and no specific results are implied or guaranteed. But we routinely obtain settlements for our clients in the $0.30-$0.50 on the dollar range, sometimes less. Here’s proof.

What type of documentation do I need to properly settle a debt?

You must always receive the terms of the settlement in writing before you release your funds to settle the debt.

At our office, the mantra is, “If it’s not in writing, it doesn’t exist.”

In addition, the settlement letter should be clear enough where a 6th grader could understand it. If the settlement letter is sloppily written and the terms of the settlement are not 100% crystal clear, request that the creditor or collection agency rewrite the letter.

After you receive a satisfactory settlement letter, then (and only then) should you release your settlement funds to finalize the matter.

Once a settlement is reached, how are the funds paid to the creditor?

In the olden days (late 1990s, early 2000s) certified funds were sent to the creditor or collection agency via overnight courier to finalize a settlement. Today this method is rarely used any more.

Starting around 2004, the industry standard for transferring funds to finalize a settlement evolved to “check-by-phone”. This means that, upon your authorization, funds are transferred electronically from your checking account to the creditor or collection agency to finalize the settlement.

This is why it is so important to get your settlement in writing before you authorize the transfer of funds—to ensure the creditor receives only the amount stated in the settlement letter.

What happens to my credit score as a result of the debt settlement process?

Time for some straight talk. Your credit will be temporarily damaged as a result of debt settlement process. Anyone who tells you otherwise is begin less than truthful.

When you settle your credit card debts via negotiated settlements, there’s a trade-off. That trade-off is substantial and immediate credit card debt relief (without the need to file bankruptcy) in exchange for less-than-perfect credit for a few years.

Having less-than-perfect credit is not the end of the world and you can function in the world just fine. Gradually your credit score will increase over time.

NOTE: There are websites claiming you can negotiate how a credit card settlement appears on your credit report. This might sound good on paper, but it doesn’t work in real life.

Creditors and collection agencies have a legal obligation under the Fair Credit Reporting Act to accurately report the facts. So if you settled your debt for less than the full balance, that is what they are required to list on your credit report.

Here’s the reality, though. We’ve had clients whose credit scores were sufficient enough to purchase a home within a year after completing the debt settlement process. So, yes, your credit score will get dinged, but it will rebound eventually … and you’ll be able to carry on as before … only now you’ll be debt-free.

I’ve heard I might have to pay taxes on any debt relief I am granted. Is that true?

It is possible that you will have to pay taxes on your debt, however you probably won’t.

The IRS code states that any amount of debt relief you receive from a creditor is treated as income. Therefore, if you settle a $10,000 credit card debt for $3,500, the $6,500 that was written off is treated as income by the IRS.

But the IRS code also states that if you were insolvent at the time of settlement, and your level of insolvency was greater than the amount of debt relief you received, you are not required to pay taxes on the amount of debt relief you received.

When you file your federal tax return, you must attach IRS Form 982 to notify the IRS of your circumstances so they know you are not obligated to pay tax on the debt relief you received.

Why shouldn’t I just file bankruptcy?

Maybe you should. Sometimes bankruptcy is the best option.

However, most people would prefer to not have bankruptcy on their record if they can avoid it because …

- If you file for bankruptcy, you will have to appear in Federal Court at least once for a hearing.

- Bankruptcy is a matter of public record for anyone to see, including future employers.

- Bankruptcy could be problematic if your current job requires a background check or security clearance.

- Bankruptcy can also remain on your credit report for up to 10 years.

- In 2005, the bankruptcy laws were overhauled, making it harder for individuals to qualify for Chapter 7 (liquidation of debt). This means that more people only qualify for Chapter 13 (partial repayment of debts) where you will have a court-appointed trustee oversee your finances for several years.

What other options are available for credit card debt relief?

There are basically four other options:

- Do Nothing: While not very practical, doing nothing about your credit card debt could work in certain situations – like if someone is unemployed and has no assets creditors could go after. This might work temporarily, but creditors can always reappear at a later date once you’ve found a job or have assets.

- Bankruptcy: For the reasons mentioned above, filing bankruptcy is often a last resort for most people. In addition, we have discovered that most people wish to avoid bankruptcy because they feel a moral responsibility to honor their debts, even if it’s paying less than what is owed.

- Debt Consolidation Loan: Obtaining a debt consolidation loan is another option. However, in order to qualify for a loan you need to provide collateral to get the loan in the first place—and many people simply don’t have sufficient collateral. Besides, even if you did qualify for a loan, you’re still going to have to pay that loan back. You’re not getting any debt relief by taking out another loan.

- Consumer Credit Counseling Service: Working with a consumer credit counseling service (CCCS) is another option. A CCCS is a non-profit organization that has an agreement with the credit card companies whereby you make one monthly payment to the CCCS, then they disburse your funds to your creditors. The CCCS can often lower your interest rates and prevent collection calls. But again, this option is not giving you debt relief. You will still have to pay your credit card balances in full plus interest.

What is the # 1 reason people choose debt settlement over bankruptcy?

After hundreds of 1-on-1 consultations with prospective clients over the past decade, it boils down to 2 words: personal responsibility.

Whether it’s religious beliefs or moral convictions, the vast majority of people acknowledge that they owe the money and feel very badly about their inability to pay it back as originally intended.

Sure, there are professional deadbeats and scam artists that don’t pay their bills, but these people are the minority. The vast majority are good, honest, decent people that acknowledge their financial commitments and want to make good on their promises.

Even when unexpected life circumstances beyond their control make it extremely difficult (if not mathematically impossible) to repay their debts, most people want to try and voluntarily pay something rather than filing bankruptcy.

I never knew credit card settlement was possible in situations of serious financial hardships like a messy/expensive divorce, job loss, and medical emergencies. My husband was in a fairly severe auto accident about six months ago, and we’ve had a lot of medical bills come up from hospitalizations and surgeries he’s gone through. We’re definitely glad his health is back on the ups, but we’ve gotten into quite a bit of credit card debt in the meantime. We’ll have to start looking for credit card settlement services in the area to see if we can get some assistance. Thanks for the information!

Hi Shayla,

I’m sorry to hear of the hardship you’ve encountered, but very happy for you that your husband is on the mend.

Feel free to reach out to us with any questions you may have regarding the process of debt settlement, and we’ll be more than happy to assist in any way we can. You may email me directly at marie@donaldsonwilliams.com

Have a great day!

Just retired and have too much debt

Hello,

If you believe debt settlement may assist you feel free to contact our office at 586-263-4590 or send me an email at marie@donaldsonwilliams.com. If we find that this is not your best option we’ll point you in the right direction.

We wish you the very best.

Marie Megge