Debt Relief Without Bankruptcy

Depending On Your Situation, You Could Be Eligible For Thousands (Even Tens Of Thousands) Of Dollars In Debt Relief!

Debt Relief Without Bankruptcy

Depending On Your Situation, You Could Be Eligible For Thousands (Even Tens Of Thousands) Of Dollars In Debt Relief!

Eliminate

crushing debt.

Private and

confidential.

No results.

No fee.

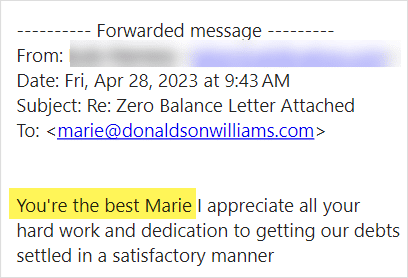

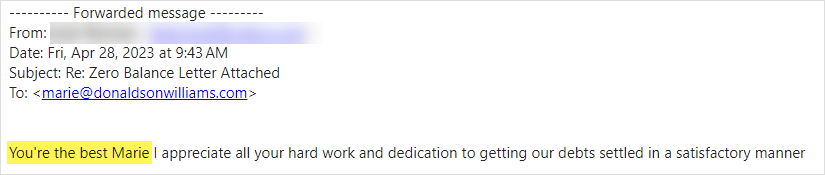

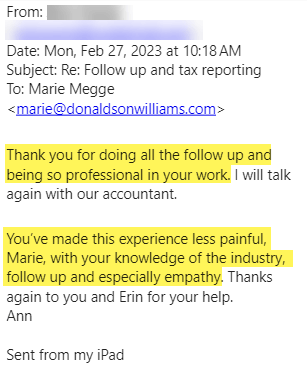

Dear Marie, I just wanted to thank you so much with helping me handle my debt that literally kept me up at night. Thank you for explaining everything so clearly right from the beginning and thank you for easing my fears when I was anxious about the whole process. You were always straightforward, genuine and honest, and I appreciate your guidance through all of this more than you know! You were continuously prompt with responding to any inquiry I had. I also want to let you know how much less stress I am feeling now and how much I appreciate all your help through this process! Forever grateful ...

Robyn

Teacher

Thank you so much for everything you’ve done for us. You and everyone at Donaldson have been nothing short of amazing. It’s a difficult thing emotionally to default on all that debt and come to terms with the fact you have collectors looking for you. You helped us get a healthier, broader perspective on the entire endeavor. I will wholeheartedly recommend you and your company to anyone else I find that is stuck in the same place we were. Our lives are completely different thanks to the folks at Donaldson and your proficiency at your craft.

Stephanie M.

Senior Commissions Analyst

Even good people suffer financial problems.

Nobody thinks it will happen to them.

But financial problems can happen to anyone — sometimes quickly and unexpectedly. For example ...

Whatever the reason, if you're currently burdened with significant debt and struggling to pay your bills, you might be eligible for significant debt relief without filing bankruptcy.

Since 2006, we’ve helped people in all stages of financial distress obtain millions of dollars of debt relief — honestly, ethically and leaving them with their dignity intact.

There's a good chance we can help you.

Virgil K.

High School Principal

"The people at Donaldson Williams, Inc. provided professional and quality customer service in the process of taking care of our excessive debt load. We feel completely satisfied with the services provided by Donaldson Williams, and we would recommend them to anyone who needs their type of services.”

Danielle

PC Systems Analyst

“I wish I had known about Donaldson Williams from the start. I got involved with a debt resolution company that took my money without settling any of my accounts. I wised up and transferred to Donaldson Williams. They are professional, kind and do what they say they are going to do. All of my accounts were settled in about 6 months. Great job and thanks so much!”

H.T.

Attorney

“From the first phone call with Marie to my very last settlement, this experience has been better than I ever expected and I kick myself for not doing it 2 years ago. I started with $47K+ and everything was settled within a year. I am thrilled with the results & a huge weight has been lifted. DW made a difficult and embarrassing situation comfortable and stress-free. They are honest, straightforward and will answer all of your questions throughout the process.”

Linda M.

Professor of Nursing

“Marie and her team were an answer to my prayers. I was so deep in debt I couldn't sleep at night. I was so afraid when I first started this process, as there are so many dishonest people trying to take your money. But you won’t have this problem with DW. I could not have found a more reputable group of people and I can’t thank them enough. I went from owing $70,000 to being debt-free. If you want someone to go to work for you and to really help, you have come to the right place.”

It's Time To Finally Eliminate Crushing Debt

The process is simple!

1. BOOK A CALL

2. CONFIRM ELIGIBILITY

3. GET DEBT RELIEF

Imagine your life without any more credit card debt

Debt happens. It’s nothing to be ashamed of.

Imagine your life without any more credit card debt or personal loan debt

Debt happens. It’s nothing to be ashamed of.

FAQ: The Debt Settlement Process

FAQ: The Debt Settlement Process

If you're struggling with excessive debt, the good news is you have options. The bad news is you don't have a lot of options.

It boils down to these five:

1. Bankruptcy. Usually a last resort for most people since it can appear on your credit report for up to 10 years. Bankruptcy is also a matter of public record for anyone that wants to know. You’ll have to appear in Federal Court for at least one hearing, possibly more. Also, the Court could require a court-appointed trustee to control and oversee your estate.

2. Consumer Credit Counseling. Usually a non-profit organization that is funded by contributions from creditors. You make one monthly payment to the consumer credit counseling agency, then they disburse your funds proportionally and pay each creditor on your behalf.

This approach can get your interest rate lowered slightly and stop the harassing collection calls. However, you will still be required to pay the full balance owed plus interest. No debt relief is granted.

3. Get A Debt Consolidation Loan. Certainly not the worst thing you could do. But getting a loan usually requires you to own a home or have some property/assets to pledge as collateral, otherwise a loan isn’t an option. In addition, you can't borrow your way out of debt. You’re still going to have to pay back the money ... plus interest. As with the previous option, no debt relief is granted.

4. Do Nothing. This is not a practical solution for most people, but technically it is an option. An example where doing nothing might work is if you were unemployed or retired and had no assets a creditor could pursue. Essentially you're “judgment proof” and your creditors would (at least temporarily) hit a roadblock. As the saying goes, you can't squeeze blood from a turnip. However, this does not mean they can’t come after you at a later date, when you least expect it. The downside with this option is that you'll still be hassled by debt collectors and your debts will still be there when you wake up in the morning, accruing interest every day.

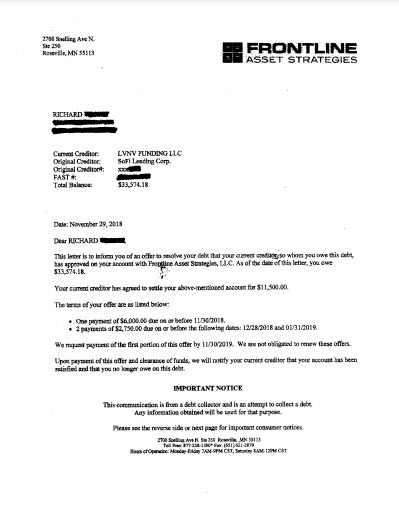

5. Negotiate Settlements For Less Than Full Balance. In certain situations, if handled correctly, most creditors will agree to accept less than full balance to settle outstanding debts -- sometimes for as little as $0.30-$0.50 on the dollar. You get much-needed debt relief without filing bankruptcy and you're able bring closure to a difficult financial situation once and for all.

Those are your choices.

There aren’t any other magical solutions for resolving outstanding debts. You can keep looking around and researching online, but I *guarantee* all roads lead back to these 5 options.

None of these options is perfect. They all have their pros and cons. If your financial situation has escalated and you know you need to do something, you'll just have to pick the option that makes the most sense for you.

The general concept is you negotiate a mutually acceptable settlement amount (for less than full balance) with a creditor or collection agency to resolve an outstanding balance.

The creditor or collection agency confirms the settlement in writing. You then remit the settlement funds prior to the agreed upon deadline. When your funds have cleared your bank, your account is settled and no further balance is due.

For more additional details on how debt settlement works, please click here.

It’s purely a business decision on their part. It takes time, effort and money to collect past due debts and/or take people to court – and then possibly collect nothing in the end. Under the right circumstances it makes more financial sense for credit card companies and collection agencies to cut their losses, settle and move on. It’s all about maximum net recovery and “not throwing good money after bad money”.

Unsecured debt — primarily credit card debt, personal loans, department store cards and some medical debt.

Secured debt cannot usually be settled because it is secured by property that can be repossessed or foreclosed upon in the event of delinquency.

Student loans, although they are not secured by property, are treated as if they were a secured debt because at the present time it is next to impossible to discharge student loans in bankruptcy. In other words, with student loans you have very little negotiating leverage because student loan debt collectors know it’s very difficult to discharge them in bankruptcy.

After hundreds of 1-on-1 consultations with prospective clients over the past decade, it boils down to 2 words: personal responsibility.

Whether it’s religious beliefs or moral convictions, the vast majority of people acknowledge that they owe the money and feel very badly about their inability to pay it back as originally intended.

Sure, there are professional deadbeats and scam artists that don’t pay their bills, but these people are the minority. The vast majority are good, honest, decent people that acknowledge their financial commitments and want to make good on their promises.

Even when unexpected life circumstances beyond their control make it extremely difficult (if not mathematically impossible) to repay their debts, most people want to try and voluntarily pay something rather than filing bankruptcy.

Maybe you should. Sometimes bankruptcy is the best option.

However, most people would prefer to not have bankruptcy on their record if they can avoid it because …

- If you file for bankruptcy, you will have to appear in Federal Court at least once for a hearing.

- Bankruptcy is a matter of public record for anyone to see, including future employers.

- Bankruptcy could be problematic if your current job requires a background check or security clearance.

- Bankruptcy can also remain on your credit report for up to 10 years.

- In 2005, the bankruptcy laws were overhauled, making it harder for individuals to qualify for Chapter 7 (liquidation of debt). This means that more people only qualify for Chapter 13 (partial repayment of debts) where you will have a court-appointed trustee oversee your finances for several years.